Property is categorized into real property and personal property. For real property insurance, the most common policies are homeowner’s insurance policies. For personal property, there are renter’s insurance, and/or insurance for scheduled valuable personal property (VPP).

Normally, homeowner’s insurance includes limited coverage on personal property, and does not cover renter’s property. Common homeowner’s policies also exclude flood and earthquake coverages which have to be purchased separately if available.

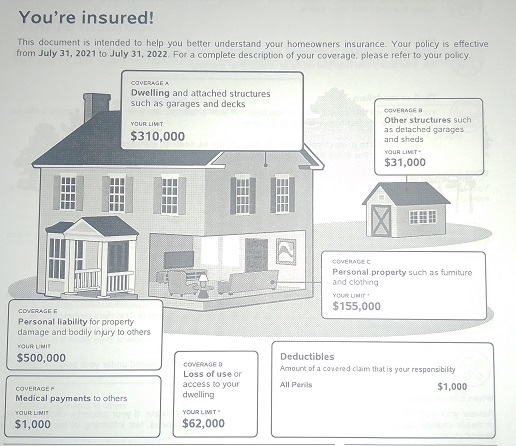

Typical homeowner’s insurance covers damages caused by fire, smoke, wind, hail, snow/ice, vandalism and theft. The figure shows an actual example of a homeowner’s policy: dwelling for the main structure, 10% of the dwelling’s coverage for other structures, 50% for personal property such as furniture and clothing, 20% for loss of use or access to dwelling (e.g., having to pay for a hotel), and a personal liability coverage for property damage and bodily injury to others, as well as a $1000 (no-fault) medical payment to others.

A good example of the personal property coverage is: say you are out attending a meeting and when you come out of the meeting, you find that your car has been broken in and some expensive cameras and equipment are stolen. You will use your auto insurance to pay for the broken window of your car while the loss of your valuables will be covered under your homeowner’s insurance (personal property).

The personal liability coverage applies even when you are away from home, for example, you accidentally cause property damage or bodily injury. Common homeowner’s policies also include the so-called “traveler’s baggage” which covers your personal belongings when you are traveling, even worldwide.

Many apartments/landlords require tenants to carry renter’s insurance. Renter’s insurance commonly include a minimum of $50,000 liability coverage for damages to the apartment (by perils including fire, smoke, explosion, water damages, etc.), medical payment, as well as coverage on personal belongings such as computers, electronics, furniture, etc.